Captive Insurance Vanuatu

An Alternative to Traditional Insurance

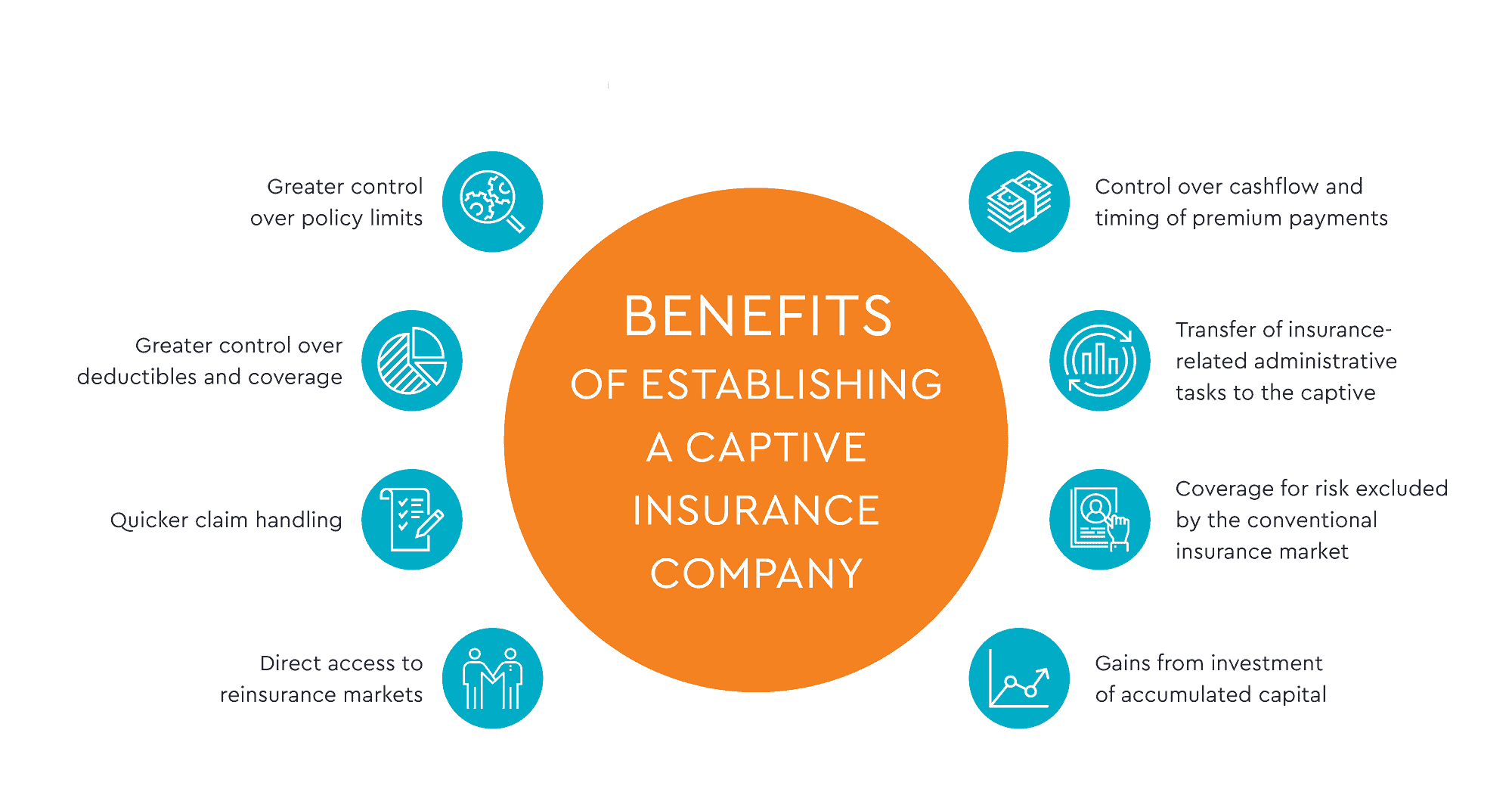

Asia is a huge growth market for captive insurance. Setting up a Captive Insurance company is a smart move when you consider the many benefits of a company managing its own risks – some of which a shown in the image below:

So, what is Captive Insurance?

In a nutshell, a captive insurance company (commonly referred to in short as a “captive”) is a licensed insurance company fully owned and controlled by its Insured(s), and accordingly operated for the Insured(s) exclusive benefit. A captive is not licensed to provide insurance cover to unrelated parties or the public at large. Thus, a captive can only provide insurance cover to its owner and/or subsidiaries of its owner.

While some might describe a captive as a type of “self-insurance”, this would be both an inaccurate and inadequate analysis of a proper captive insurance structure. For example, as is the practice of almost every traditional insurance company, a captive will usually purchase reinsurance so as to set-off the ultimate costs of claims should such costs exceed a predetermined level, commonly referred to as the “deductible” or “excess”.

Most importantly, a captive’s insurance cover has to be bona fide, the captive has to be financially able to meet its claims, and it has to be contractually (legally) bound to meet them, as traditional insurance companies are required to be, otherwise any so-called insurance cover would be a sham.

A key difference between a traditional insurer and a captive insurer is that the traditional insurer prices its premiums, and manages its claims, in a way to make a profit (from you); whereas a captive insurer prices its premiums to meet the costs of (your) claims – in respect of which, it would be highly unlikely that (you) the owner would deny one’s own claims.

Furthermore, the profits made from you by a traditional insurance company are kept by them, whereas, the profits of a captive (in whole or in part) can be returned to its owner or otherwise utilised to reduce the future costs of premiums and reinsurance and/or to enhance safety and risk management programs for the benefit of both the captive and its owner. A properly structured and functional captive can ultimately add significant value to its owner’s core business.

Captive insurance in Asia

As the risk profile of global groups shifts toward Asia, and as more Asian conglomerates expand globally, both existing and up-and-coming Asian jurisdictions are revisiting their captive regimes to capture the expected growth. At the same time, revisions are being considered to their tax regimes to conform to OECD requirements, specifically concerning minimum substance under BEPS (Base erosion and profit shifting).

Asia has seen a significant growth in recent years, increasing by about 30% from 129 in 2015 to 168 in 2018. Singapore and Labuan lead the number of captives in the Asian region. At the end of 2019, Asia accounted for about 3% of captives globally, with approximately 168 of the total 6,315 domiciled in Asian jurisdictions.

Hong Kong is a relatively recent market entrant to the captive insurance world market. In light of China’s national policy initiatives, such as the Greater Bay Area initiative and the broader Belt and Road Initiative, Hong Kong has a larger role to play as a risk management hub and captive location. Accordingly, HK’s Government started to promote the insurance sector in recent years.

Under the Insurance (Amendment) Bill 2020, passed in late July, HK captives are now permitted to write overseas group business, not just HK domestic business. The previous limitation of being able to ensure only HK incorporated and registered companies severely limited the usefulness of HK captives for multinational groups. HK has also recently updated its tax concession for authorized captive insurers in HK by dropping the limitation of the 50% reduction in the corporate income tax rate in HK to offshore risks.

Captive Insurance in the Pacific – The Pacific region, in particular Vanuatu, also offers a low cost, and a comparatively friendlier regulatory regime, for mid to small businesses than most other captive domiciles.

One of the earliest captive domiciles, Vanuatu, introduced captive insurance rules between 1975 and 1977. It had then drawn corporations from the United States, Australia, New Zealand and Hong Kong to form captives. Captive classes mainly came from medical liability, legal, life insurance and income and employee protection.

However, due to Vanuatu’s early adoption of OECD rules, and the advent of new captive jurisdictions, including the United States, the number of captive insurers plunged from about 150 companies to about 30 a decade ago. However, Vanuatu is now reinventing itself as a financial center, with a strong focus on captive insurance, supported by newly enacted legal and regulatory frameworks in line with international standards.

Indeed, Vanuatu offers a world of opportunities in the Pacific Asia regions, similar to, and often superior to those offered by the Cayman Islands, St Kitts and Bermuda. For this reason, China Pacific Partners maintains a fully staffed office in Vanuatu’s capital of Port Vila.

Is Captive insurance legal?

A captive is a legitimate licensed insurance company. The insurance cover provided by a captive to its Insured (the owner), as earlier mentioned, has to be bona fide. But why wouldn’t it be, you ask? – Well, in some cases, captives have been used as little more than an illegitimate tax scheme (as distinct from a legitimate tax shelter) where tax-deductible premiums are paid to the captive without a real risk of a claim being made; i.e., paying for cover against a non-existent or fanciful risk, but getting a tax deduction for it. It’s a bit like false invoicing.

The captive’s premiums also have to be commercially commensurate to the risks covered; in other words, the premiums cannot be artificial or inflated, which is a tell-tale sign the captive is being used to questionably divest money or to get unjustified tax deductions.

Captive insurance legislation, under which captives are governed, does not exist in every country. Hence, captives operate in and from a “domiciles” (countries) that have insurance legislation providing for the establishment and operation of captives. There are approximatetly 70 such domiciles around the world (see a list of the leading captive domiciles later on this page).

Note: Some countries have laws which prevent, or otherwise restrict, their citizens and resident corporations, and other resident entities, insuring with an offshore foreign insurer (an insurer not licensed to insure risks in that country). Furthermore, some countries, may in-fact, prohibit offshore insurers from insuring certain classes of risks, such as where insurance is statutorily mandated – third party personal injury for motor vehicles, for example. It is thus critical to determine as the first step, before even embarking on a feasibility study, whether the laws of a prospective owner’s home country may prohibit or somehow restrict their use of captive insurance.

Did you know that more than 470 of the Forbes 500 Companies have their own captive insurance facilities

Choosing the Right Captive Domicile

A captive domicile is the location (or jurisdiction) where a captive insurer is licensed to do business. Indeed there are more than 70 captive domiciles around the world, underwriting an estimated combined premium income in excess of USD$70billion. [2] The leading international (non-US / offshore) captive domiciles are:

- Guernsey

- Mauritius

- Singapore

- Bermuda

- Cayman Islands

- Ireland

- Vanuatu

- Isle of Man

- Bahamas

- Labuan

- Anguilla

- Brith Virgin Islands

- Belize

- Gibraltar

- Turks & Caicos Islands

- Luxembourg

- Dubai Int’l Financial Centre

- Qatar Financial Centre

Note: The United States of America has approximatly 3,000 captives accross 30 states. [3]

Each captive domicile is slightly different in the way it regulates its captives. Some are more regulated than others. Thus, in some highly regulated domiciles, the costs of establishment and ongoing management is a critical factor in choosing which domicle to locate a captive, particularly at a captive’s inception. Horses for courses, as it were.

Indeed, the captive domiciles compete with one another, offering variable minimum capitalisation requirements designed to encourage, or discourage, certain types of captives; for example, Bermuda and Guernsey are highly regulated captive domiciles which tend to attract very large multi-national companies and government agencies, and ‘long tail’ reinsurance and run-off companies, where full-time dedicated claims and administrative teams are required, and where expensive ongoing actuarial analysis is critical.

Whereas, Labuan (part of Malaysia) and Vanuatu, for example, are more geared for mid-sized companies, including small to mid-sized multi-national firms, with annual revenues of less than USD$1billion. Furthermore, Labuan offers Islamic compliant insurance (“Takaful”), and Vanuatu offers a regulatory and cost effective environment which encourages entrepreneurial start-ups and small-to-medium sized businesses with annual revenue of less than USD$5million – from zero for start-ups. [4]

Note: While captive insurance is predominantly used by businesses (as well as NPOs and NGOs) to better manage and protect against their own particular risks, captive insurance is also routinely utilised by wealthy families and high-net-worth individuals to guard against the unique risks they are potentially exposed to. More on this later.

It is thus very important, indeed critical, that the right domicile be chosen that will best suit the particular size, scope and complexity of the captive’s insurance cover that it is proposed to provide for its owner. One of the truly great things about having a captive is that it can be relatively easily redomiciled to meet the ongoing needs of the owner’s core business operations. For example, if the owner’s business grows, or takes a different direction that makes a material and fundamental difference to its risk exposure, the existing captive might require additional services otherwise only (or best) available in another domicile. The captive’s retained profits and intellectual property move with it.

Note: Most regulators, in most domiciles, require that ‘captive service providers’ conduct due diligence on the proposed ultimate beneficial owners of the captive insurer. Strict rules apply in relation to persons connected with countries designated by FATF as high-risk or as having inadequate systems and controls to combat money laundering and terrorist financing. This usually forms initial part of the ‘feasibility study’.

What Classes of Insurance Can a Captive Underwrite?

Generally speaking, a captive insurer can underwrite all traditional classes of insurance, and can tailor existing policies to suit the captive owner’s specific requirements. Moreover, a captive can, and often does, create bespoke or hybrid, policies of insurance particular to the owner’s needs. Essentially, there is no restriction as to what a captive insurer can insure. However, most policies cover traditional lines in modified and customised wordings. Some examples of which follow:

- Property & Construction

- Casualty

- Motor

- Financial lines (E&O/D&O)

- Marine & Aviation

- Energy & Mining

- Terrorism risks

- Surety (Bonds/Hedge Funds)

- Trade credit

- Political risk

- Basic & Supplemental life

- Long term disability

- Non-qualified benefit

- Kidnap & Ransom

- Business travel accident

- Accidental death & trauma

- Retiree medical

- Active medical

- Medical stop loss

- Workers’ compensation

- Cyber Extortion

Cover can be tailored to include risks directly associated with war, supply chain disruption as a result of war, terrorism, and political risks -including as to changes in legislation which detrimentally impact business operations- even as a result pandemic. The list of risks and variations of risks that can be insured against is almost limitless, subject of course to the obtaining of reinsurance support where and if necessary.

Who is Captive Insurance suitable for?

Captive insurance is suitable for a wide variety of incorporated and unincorporated entities, including not-profit organisations (NPOs) and non-government organisations (NGOs).

Captive insurance is ideally suited for established entities which have a track record of a ‘profitable claims history’. Generally speaking, this means that, over a measurable period of time, a traditional insurer has made a profit from insuring your risks. Thus, potentially, the benefits of continuous profitable insurance can become yours, for example, by way of dividends and/or reduced insurance premiums.

Captive insurance is also ideal for Start-ups, where projections as to claims costs can be credibly, though estimatingly, measured analogously against ‘open market’ premiums and claims experience, so that tailored insurance can be written and priced to cover against risks likely faced. Sometimes, it will be virgin territory for Start-ups, hence the significant benefit of designing insurance for one’s own particular and peculiar needs.

Note: Silicon Valley start-ups are a great example of dynamic entrepreneurially driven businesses that rely on equally dynamic reactive and proactive insurance programs tailored for each of their peculiar needs; i.e., Uber’s and Twitter’s risk exposures (including as to worldwide liability) are fundamentally different, but without such individualised cover provided by their own captives, these businesses could not have secured the funding to go forth and conquer as they have done. Indeed, going forward, their captives have the flexibility of altering, modifying and extending the cover parameters, at any time, without penalty, so as to accommodate challenges and opportunities arising from their worldwide operations. Try getting that from a traditional insurance company … Lol!

Historically, captive insurance, up until the mid-1990s was predominantly the realm of large multi-nationals, particularly those engaged in the energy, forestry and mining sectors, as well as the banking, pharmaceutical, armament and munitions industries. However, as captive insurance has become more mainstream, largely as a result of modern communications and technologies, captives are now routinely utilised by many small to mid-sized companies, and similar enterprise-based entities, including professional practices and trusts. Indeed, captives have played a significant role in providing tailored insurance solutions to facilitate research and development across a vast array of technology and pharma.

Interestingly, a number of local governments (i.e., city, shire, district and municipal councils) around the world have also become captive owners as they’ve found it increasingly difficult and expensive to obtain a total level of cover from the traditional insurance market to meet the many challenges that the public sector faces. In some cases the bulk of their insurance remains placed with traditional insuers, with their captives filling looming gaps in the cover.

One of the fastest growing sectors of the captive insurance industry is that of hedging insurance, which engages a similar strategy to that of how hedge funds operate. For example, companies / traders can set-up a captive insurer for the specific purpose of insuring against market and commodity fluctuations, such as for example, for fuels (crude & refined oil), rates of currency exchange, futures (forward contracts) and precious and rare metals, but to name just a few.

This puts the management of such risks in the grasp and control of the commodity owner / purchaser (or guarantor) rather than in the hands of an isolated (and usually very expensive) hedge fund manager whose interests might not necessarily, at all times, align with the Insured’s.

Wealthy families and ultra hi-net-worth individuals

Captive insurance isn’t just restricted to business and commercial affairs: as mentioned, many wealthy families and hi-net-worth (and ultra hi-net worth) individuals have their own captive insurance programs to guard against the potential risks they are uniquely exposed to. Kidnap and ransom, for example, are clear risks associated with people of wealth and power. Even threats of kidnap and other acts of violence can severely affect such people, their families, friends and associates, their businesses, including their employees, and even their neighbours.

Indeed, family disputes as to business accession and familias inheritance can result in major legal disputes effecting the functionality of family and the value of assets in distributable dispute. A captive’s insurance cover can be designed to cover such risks offering alternatives pathways to provide compensation and thus lessen the drain on family resources. Of course, whether the cover, either in part or whole, is sufficiently nexus to the generation of income, whether active or passive income, will determine whether premiums for such cover, in part or whole, is tax deductable. Careful drafting of such an insurance policy’s cover would necessarily require expert legal and actuarial advice.

With higher premiums, a lack of capacity, increased deductibles, and more stringent terms and conditions, captive insurance use is more popular than ever.

Basically how Captive Insurance works:

– Insurance management

The insurance manager operates the captive on behalf of the captive owner. Cost, relevant expertise and independence are factors in choosing an insurance manager.

Note: Underwriting expertise is fundamental. A captive underwriting a line of coverage for which it does not have any prior experience or particular expertise is fraught with danger. Thus, having an experienced manager is critical to the captive’s ultimate viability. As part of our services, we will ensure that management and underwriting expertise is engaged with agreed ‘underwriting criteria’ supported by reinsurance. (see below)

– Audit and actuarial costs

The opinion of an approved auditor and in some cases an approved actuary is required as part of statutory reporting. Costs are generally comparable among firms of the same tier, and the captive will often use the captive owner’s group auditors.

– Licensing fees, annual fees, regulatory fees

These vary in different domiciles, and can be structured very differently, making comparison challenging. Regulatory fees in Bermuda have been relatively static over the past 10 years.

– Directors, corporate secretary

The board of a captive should include local directors with relevant expertise and experience. The local directors enhance board diversification, introduce a wealth of local industry knowledge and support economic substance requirements. A local corporate service provider with a good record of accomplishment in captives provides a registered office and helps to maintain regulatory compliance. They arrange board and statutory meetings and keep corporate records for the captive.

– Fronting, third party administrators

Sometimes a fronting insurer is required to issue insurance policies on behalf of the captive. Fronting insurers retain no risk contractually, and are typically traditional, licensed insurers based in the same jurisdiction as the captive owner. Third party administrators (TPA) help with claim processing and other administrative tasks for the captive. The need for a TPA depends on the nature, scale and complexity of the insurance business written.

Reinsurance is critical

When a captive insurer issues a policy to its parent, it assumes the primary legal responsibility to pay covered claims. Thus, a fundamental requirement is that the captive must reasonably be able to meet its claims liabilities, current and projected. A captive cannot be ‘a house of cards’.

In most cases, a captive insurer will need to purchase reinsurance cover from the open market, but usually at a ‘wholesale’ cost. Essentially, with reinsurance, the captive takes the first part of the risk (as in a deductable or excess) and the reinsurer picks up the balance. Sometimes this is called setting-off the risk. I.e., Potential “primary” Liability $1,000,000 | Captive @ $100,000 | Reinsurer @ $900,000.

However, generally speaking, the captive insurer cannot escape this primary liability even if the reinsurer that is supposed to be sharing the risk cannot or does not perform. Thus, managing risk through reliable and strong reinsurance is critically important to any properly structured captive insurance program.

Our Captive insurance services

On instruction, in the first instance, we will evaluate whether a captive insurance structure, prima-face, will ultimately serve your needs. An essential part of this initial process will be to determine whether, in all the circumstances, the formation a captive can be financially justified. This is usually achieved in a 3 step process:

– Feasibility and Goals of a Captive

– Domicile Selection

– Service Provider Selection

Determining the feasibility and goals of a Captive:

The process of forming a captive usually begins with a feasibility study of your loss history and past claims. This will determine the accepted loss level and level of claims for your business (enterprise or other) and gives clear trends and attachment points for premiums, costs, and reinsurance. This information is fundermenatl to determining if forming a captive is your best option. In some cases a Protected Cell Structure or a Discretonary Mutual Trust might be a better fit. It is thus imperative to determine in the early stages of formation if the proposal of using a captive, and in what form, will result in any anticipated long-term solution.

For Start-ups – Claims history and loss levels will, likely, not be avaialable. However, related industry losses and trends can be applied directly or broadly to the start-up’s business plan to guage a claims v premium ratio. The engagement of an actuary for this purpose will likely be neccesry.

Where the scope of the proposed captive is complex, specialised experts may need to be engaged, such as actuaries, accountants and lawyers, partciularaly in relation to analaysing tax implications, if any, and the adeqaucy of the proposed policy wordings.

Domicile selection

With the feasibility study complete and clear goals outlined, it will be time to select a domicile. There are many reasons for making the decision on where to form the captive. Depending on the size, scope and complexity of the classes of insurance the captive is proposed to underwite will be a key consideration. A primary consideration will be the initial capitilisation costs required to establish the captive – some jurisdictions have very low minimum capital requirements of just USD$100,000. Careful consideration must also be given to the regulatory environment and how the goals of the captive align with that environment; such as having a flexible regulalatory attitude allowing for creative solutions while simultaneously applying regulations appropriately for the health and solvency of the captive. That said, expenses and profits will likely be more affected by the structure and choice of captive manager.

Why are most captives in tax havens?

The term “tax haven” is an unfortunate one. It conjures up all sorts of financial skulduggery. Indeed, the term applied to the various domiciles shown above, in the context of captive insurance, is quite unfair because they are not entirely devoid of taxes as there are transactional taxes in addition to VAT / GST. A more accurate term is “tax neutral”, which is ideal for a captive domicile because, in effect, all the profits of the captive are retained and can be used for the benefit of the captive such as to reduce its reliance on reinsurance, and thus the cost of reinsurance going forward, and/or as well to reduce the premiums if desirable. Ultimately, the retained profits of the captive can be returned to the captive’s owner, by dividend, on which it is likely the owner will have to pay tax on in their home jurisdiction. As the captive is an “active business’, its income will not( in most circumstances) be attributable to the owner as passive income (such as for rent, royalties and similar passive sources). When conducting a feasibility report, in the first instance, it will be necessary for an expert accountant’s opinion to be obtained in the owner’s home jurisdiction so as to determine the tax effect of the arrangement.

Service provider selection

Upon selecting a domicile, a captive manager will need to be selected. In most cases, the captive manager will be able to provide the services neccesery to operate the captive; this may include attorney and accountant services, tax adviserory, banking and if neccessery actuarial services. Together with the captive manager we will assist in the preparation of a business plan, which will be instrumental in gaining regulatory approval and reinsurance support. The importance of the business plan for making a case for forming the captive cannot be overstated. It is also critical that all service providers have a level of expertise about captives and be knowledgeable and supportive of your goals and expectations for the captive. Since a captive is a company or corporation, officers and directors are needed. This will form part ofthe application and incorporation process.

After the Captive is established:

More often than not, however, we will usually not be involved in day-to-day management of the captive as we are fundamentally an ‘independent consultancy’, and as such, we maintain our independence by surveilling the captive’s management and underwriting practices so as to ensure compliance with the captive’s intent. As mentioned, underwriting expertise is critical to the captive’s profitability, and ultimate viability. As part of our services, we will ensure that management expertise is maintained with agreed ‘underwriting criteria’ supported by reinsurance.

Ultimately, our job is to add value throughout the life cycle of the captive, from incorporation and licensing, to unwinding and voluntary liquidations when the structure ends its natural life – precision and technical expertise has been the hallmark of our service offerings to this important global industry.

If you would like to discuss how we might be able to assist in evaluating your captive insurance needs, please contact us on the details below.

- Guernsey

- Mauritius

- Singapore

- Bermuda

- Cayman Islands

- Ireland

- Vanuatu

- Isle of Man

- Bahamas

- Labuan

- Anguilla

- Brith Virgin Islands

- Belize

- Gibraltar

- Turks & Caicos Islands

- Luxembourg

- Dubai Int’l Financial Centre

- Qatar Financial Centre

GENUINE PRIVATE ADVICE YOU CAN RELY ON

China Pacific Partners offers confidential professional advice across a wide range of financial strategies for institutional and private clients living or investing in the Asia Pacific & Oceanic region.

With long-standing local and global affiliations, we can advise on medium and long-term financial strategies from an international perspective, focusing on those core sectors that we know well and understand.

With a combination of digital convenience and human investment expertise, our goal is to increase and protect your assets over the long term. Whatever your financial needs, we never lose sight of your objectives.

Our Captive insurance services

[2] Captive Insurance Companies Association (CICA) – https://www.irmi.com

[3] US States with captive insurance legislation as at 31-Dec-21 – Alabama, Arizona, Arkansas, Colorado, Connecticut, Delaware, Delaware Tribe of Indians, District of Columbia, Florida, Georgia, Guam, Hawaii, Illinois, Kansas, Kentucky, Louisiana, Maine, Michigan, Missouri, Montana, Nebraska, Nevada, New Jersey, New York, North Carolina, Ohio, Oklahoma, Oregon, Puerto Rico, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, US Virgin Islands, Utah, Vermont, Virginia, West Virginia.