Strategic Corporate Services Ltd’

– Vanuatu & Worldwide –

Harnessing Blue Sky Opportunities: Tailored Structured Finance Advisory Services for High Net Worth Individuals and Investment Funds

Welcome to Strategic Corporate Services Ltd (Vanuatu), where we specialise in providing structured finance advisory services for high net worth individuals, companies, entrepreneurs, and investment funds.

Our expertise covers a wide spectrum of financial instruments, offering comprehensive solutions in traditional and hybrid finance strategies, from collateral lending to private bonds, syndicated loans, and partnered finance. Our focus on tax-effective offshore finance solutions enables clients to seize blue-sky opportunities, maximising investment potential while safeguarding wealth.

Whether you’re seeking to optimise your portfolio or explore innovative financing avenues, for a commercial or private purpose, our dedicated team is committed to delivering customised solutions to turn your financial aspirations into reality.

Our Expertise at a Glance

Hybrid Finance

Blending traditional & innovative financing methods to tailor unique strategies for diverse financial needs.

Alternative Collateral

Widens financing options, unlocks unconventional assets, diversifies risk of traditional holdings.

Syndicated Loans

Offers diversified funding sources, flexibility, and tailored solutions, surpassing traditional loan providors.

Tax Efficiency

Offshore finance from Vanuatu can offer tax efficiency through its favourable tax regime.

Strategic Structuring – Unhindered by burdensome regulatory restrictions, we can design tailored financing strategies that optimise funding for both borrowers and lenders alike, while ensuring compliance with applicable laws and regulations. Our solutions are often enhanced by leveraging Vanuatu Company and Trust structures, providing our clients with unparalleled asset protection through legally enforced confidentiality. By combining our extensive knowledge of structured finance with the unique advantages offered by Vanuatu jurisdiction, we empower our clients to achieve their financial objectives with confidence and peace of mind.

About Us

Strategic Corporate Services Ltd is a leading independent Vanuatu professional services firm offering a comprehensive array of services to both corporate and private clients. Central to our range of services, is providing impartial guidance and solutions uniquely customised to meet the diverse funding needs of clients, spanning property purchase and development, both onshore and offshore, project development to advance business interests, and financing for yachts and aircraft, including by way of direct and/or novated leases.*

With years of experience navigating the intricate landscape of international finance and legal frameworks, we’re able to provide tailored solutions that meet the unique needs of our clients. From establishing robust trust and corporate structures to ongoing management and compliance, we ensure peace of mind and financial security for individuals, families, businesses, and organisations worldwide.*

Our in-house legal counsel oversees all communications, ensuring clients benefit from legal professional privilege and confidentiality in all their interactions and arrangements.

The Benefits of Offshore Structured Finance

The benefit of offshore structured finance lies in its ability to provide flexible and efficient financing solutions while leveraging the advantages offered by offshore jurisdictions. Here are some key benefits:

- Tax efficiency: Offshore structured finance often allows for tax optimisation strategies, such as reduced tax rates, tax exemptions, or tax deferral, which can lead to significant cost savings for investors and borrowers.

- Asset protection: Offshore jurisdictions typically offer strong asset protection laws and confidentiality provisions, providing a secure environment for structuring financial transactions and safeguarding assets from potential legal or regulatory risks.

- Diversification: Offshore structured finance enables investors to diversify their investment portfolios across different jurisdictions and asset classes, reducing concentration risk and enhancing overall portfolio resilience.

- Regulatory flexibility: Offshore jurisdictions may have less stringent regulatory requirements compared to onshore jurisdictions, allowing for greater flexibility in structuring financial transactions and reducing regulatory burdens for market participants.

- Privacy and confidentiality: Offshore structured finance transactions often benefit from enhanced privacy and confidentiality provisions, protecting the identities of investors and borrowers and maintaining confidentiality of sensitive financial information.

- Access to global markets: Offshore structured finance facilitates access to global capital markets and a broader range of investment opportunities, enabling investors and borrowers to tap into international funding sources and expand their business operations globally.

Vanuatu stands out as a modern and facilitative jurisdiction, dedicated to empowering entrepreneurs to achieve their goals. With its progressive legal framework and tailored legislation, based on English law, Vanuatu offers a conducive environment for offshore structured finance. This jurisdictional advantage, coupled with these benefits makes Vanuatu an attractive destination for sophisticated investors and corporate entities seeking tailored financing solutions.

Exploring Non-Traditional Structured Finance: Innovative Solutions for Modern Challenges

Non-traditional structured finance refers to financial arrangements that deviate from conventional or traditional methods of structuring financial transactions. While traditional structured finance typically involves assets like mortgages, loans, and bonds, non-traditional structured finance goes further venturing into more unconventional territory. This can include:

- Hybrid finance solutions: Blending traditional and innovative financing methods to tailor unique strategies for diverse financial needs. These approaches offer flexibility, efficiency, and tailored solutions, enabling access to capital and risk management in non-traditional ways.

- Alternative collateral: Using alternative collateral to secure funding offers a broader range of benefits compared to non-traditional collateral methods. It allows for greater flexibility in asset selection, potentially unlocking financing opportunities that may not be accessible through conventional means. Additionally, alternative collateral can provide better risk mitigation by diversifying the asset base and reducing reliance on traditional forms of security. This approach offers innovative solutions to meet evolving financing needs while enhancing overall portfolio resilience.

+ Non-traditional structured finance may involve the use of alternative assets such as intellectual property rights, royalties, or future cash flows (incl’ Crypto) from specific revenue-generating activities. - Specialised industries: Such may focus on financing arrangements tailored to specific industries or sectors that require unique funding solutions, such as healthcare and medicinal research and development, renewable energy, and technology startups.

- Complex derivatives: Non-traditional structured finance can also encompass complex derivative instruments or financial products -including Crypto currency and Digital assets- that are customised to meet the specific risk management or investment objectives of borrowers and lenders, alike.

- Hybrid structures: Which may involve the creation of hybrid financial structures that combine elements of traditional debt financing with equity participation or other forms of contingent -though enforcable- payment arrangements.

- Note: Our firm also works with most major currencies including: USD$, EUR €, JPY ¥ / 円, GBP £, CNY ¥ / 元, AUD A$, CAD C$, CHF, HKD HK$, SGD S$, SEK kr, KRW ₩ / 원, NOK kr, NZD NZ$, INR ₹, MXN $, TWD NT$, ZAR R, BRL R$, DKK kr, PLN zł, THB ฿, ILS ₪, IDR Rp, CZK Kč, AED د.إ, TRY ₺, HUF Ft, CLP$, SAR ﷼, PHP ₱, MYR RM, COL$, RUB ₽ – as well as most major Crypto-currencies.

Overall, non-traditional structured finance offers innovative solutions to meet the evolving needs of market participants and address challenges that may not be adequately addressed by conventional financing methods.

Unlocking Opportunities: Benefits of Syndicated Loans from Private Lenders

A ‘syndicated loan’ provided by private and/or specialised institutional lenders offers several advantages from both perspectives of streamlined processes and entrepreneurial understanding. Unlike traditional lenders, private lenders typically operate with less red tape, allowing for quicker decision-making and funding processes.

Moreover, private and specialised institutional lenders often possess a deeper understanding of entrepreneurial ventures and are more willing to engage in flexible financing arrangements tailored to the unique needs of the borrower. This can include establishing beneficial partnerships in current and ongoing projects, where private lenders may take on a more active role and provide valuable expertise or resources to ensure project success.

A key feature of private lenders is their personal interest in seeing the project succeed, often leading them to take on de facto partnerships in ‘debt-for-equity’ financing arrangements, which is one of the fastest-growing areas of structured finance practice.

Benefits of Debt-for-Equity Loans: Restructuring Debt and Sharing Risks

This conversion of debt into equity can provide several benefits for both the borrower and the lender:

- Debt reduction: By converting debt into equity, the borrower can reduce its overall debt burden, improving its financial leverage and debt-to-equity ratio.

- Equity infusion: The conversion of debt into equity provides the borrower with additional equity capital, which can be used to strengthen the company’s balance sheet, fund growth initiatives, or meet other capital requirements.

- Risk sharing: For the lender, converting debt into equity allows them to share in the company’s future performance and potential upside, aligning their interests more closely with those of the borrower.

Overall, debt-for-equity loans offer a mechanism for companies to restructure their debt obligations and strengthen their financial position, while providing lenders with an opportunity to participate in the long-term success of the borrower.

Note: Debt-for-equity loans can occasionally draw scrutiny from tax regulators, who may scrutinise them for potential tax implications, particularly concerning the treatment of income provisions. This scrutiny often centers on the structure of the loan agreement, particularly whether it reflects the implicit nature of an arms-length transaction between the borrower and the lender.*

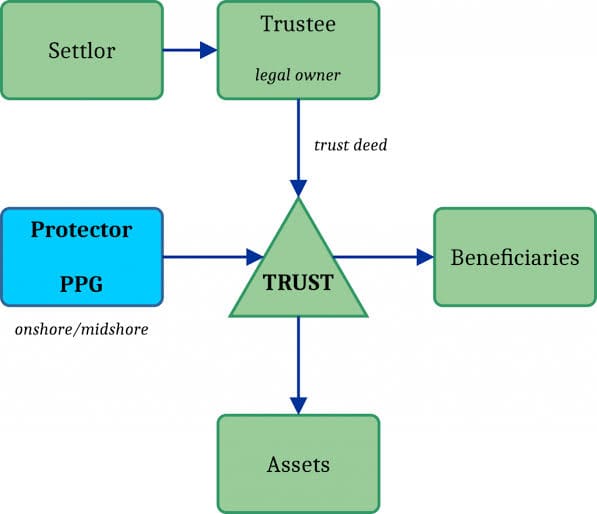

While establishing a company in Vanuatu can be a prudent strategy for financing commercial projects or holding assets, such as yachts or aircraft, the versatility and advantages of trust structured asset ownership ought be considered. Trusts, in combination with a corporate entity offer a dynamic and flexible approach to asset management, operating across multiple jurisdictions and benefiting from the most advantageous legal frameworks. As they say, the devil is in the detail, thus crafting a Trust Deed with clear and unambiguous intentions and protections is paramount to avoiding legal disputes down the line.

Our Trust Expertise & Affiliations

At Strategic Corporate Services, we specialise in preparing and establishing trusts, ensuring that the intentions of the trust are safeguarded and carried out as intended.

Our firm boasts a network of affiliations with trust experts spanning various jurisdictions. This enables us to provide independent advice and ongoing support throughout the decision-making process, ensuring that your wealth protection strategy is tailored to your specific needs and goals.

Protecting your assets begins today, and by entrusting Strategic Corporate Services, you’re securing the financial future of your children and future generations. Learn more about Vanuatu’s role as an Offshore Financial Centers in Global Private Credit …

Our Corporate Services

Selecting the most suitable company structure demands careful and thorough professional analysis. We’re dedicated to collaborating closely with our clients and their representatives to craft tailored structures and strategies that precisely match their unique and particular needs. Instead of applying a generic approach, we prioritise customisation to ensure optimal outcomes for every client. Learn more …

Initial Contact

In the first instance, all initial enquires should be made via our ‘secure contact portal’. Upon receipt, we shall promptly arrange a mutually convenient time for an initial consultation.

Secure Contact Portal

Note: Our services are not offered to Australian or New Zealand interests

For convenience, we typically conduct electronic face-to-face meetings, often via Skype or a similar platform. These meetings allow us to assess the scope and complexity of your intentions, ensuring compliance with your objectives. Additionally, this serves as the first step in our Know Your Customer (KYC) obligations, which we strive to make as unintrusive as possible.

For our high (and ultra-high) net worth clients and families, we go the extra mile by arranging one of our legal representatives to meet you or your designated representative(s) at a mutually convenient location. This ensures that we can provide personalised and comprehensive services tailored to your specific needs and circumstances.

Fees

Our professional fees are structured in alignment with the scope services rendered, as well as any necessary costs, including for application and establishment, and disbursements incurred. We believe in transparency and fairness, ensuring that our clients receive value for their investment. Additionally, we offer complimentary initial consultations, allowing prospective clients to explore our services without any financial obligation.

Confidentiality & Privilege

Confidentiality and discretion is paramount. Our team, overseen by in-house legal counsel, ensures all services meet stringent legal compliance standards, safeguarding our clients’ interests and unique structures. Thus, we prioritise the highest levels of confidentiality to protect our clients’ sensitive information.

With robust measures in place, we mitigate risks of unauthorised access or breaches, providing clients peace of mind and assurance that their affairs are securely handled with professionalism and care. Learn more …

* Strategic Corporate Services Ltd is not a financier. Instead, we maintain an independent advisory role across all facets of clients’ financing arrangements, including serving as a facilitator and manager.

Specialty Lending

Luxury Yacht and Aircraft Financing

We tailor structured financing for luxury assets like yachts (incl’ superyachts) and private or corporate aircraft. Our bespoke solutions are designed to facilitate the purchase of new or pre-owned vessels and aircraft, or unlock liquidity from existing assets. With our experienced team, you can expect a seamless process tailored to your financial goals and lifestyle preferences.

Indeed, our yacht financing options provide liquidity in traditionally illiquid assets, preserving equity capital for other investments or ventures. Similarly, our aircraft financing solutions allow you to maintain your investment strategy while diversifying your sources of liquidity. With our experienced team, you can expect a seamless process tailored to your financial goals and lifestyle preferences.

- Strategic Corporate Services Ltd is one of just a handfull of finance facilitators, offering a unique capability to arrange finance for options on build lines, funding deposits for the build-delivery of aircraft and yachts. This distinctive service alleviates clients from the burden of utilising working capital for non-productive optioned deposits, ensuring efficient use of resources and enabling them to focus on their core business objectives.

Fine Art Financing

At Strategic Corporate Services Ltd, we understand the significance of fine art in your investment portfolio. Our fine art financing solutions offer liquidity while allowing you to retain ownership of your valuable pieces. Whether you’re looking to expand your collection, fund new investments, or pursue other financial goals, we can help you do so without disrupting your overall investment strategy. Fine art financing provides a valuable source of liquidity and financial flexibility, making it an essential component of a sophisticated wealth planning strategy.

Life Insurance Premium Financing

We recognise the importance of integrating life insurance premium financing into your estate planning strategy. By adding a borrowing strategy to your plans, you can safeguard your heirs’ financial future while protecting your current financial position. Paying death taxes can lead to a liquidity crisis for your estate’s executors, potentially forcing them to sell assets hastily or face undesirable outcomes.

Financing the cost of a high-value insurance policy offers numerous benefits, including maximising coverage without impacting your cash flow, avoiding the need to sell assets to cover premiums, and allowing tax-free growth of investments within the policy. With access to liquidity at favorable interest rates, life insurance premium financing is a valuable tool for securing your legacy and ensuring the financial well-being of your loved ones.

Structured Finance