Strategic Corporate Services Ltd’

– Vanuatu & Worldwide –

Empowering Financial Security: Vanuatu Trust Solutions & Advisory

Our expertise in Vanuatu trusts provides effective solutions for asset protection and estate planning, regardless of your location or tax resident status.

With our wide array of trust advisory services, we can cater to individuals, families, companies, and charitable foundations, ensuring optimal structures for safeguarding assets and achieving long-term financial goals.

Our Expertise at a Glance

Offshore Trusts

Asset protection, tax optimisation, and flexibility to leverage favourable laws or relocate as needed.

Discretionary Trusts

Asset protection, control, and flexibility for beneficiaries’ distributions and tax planning.

Escrow Trusts

Secure holding of assets until specified conditions are met for contractual transactions: i.e., settlements & completion.

Estate Trusts

Efficient wealth transfer, asset protection, and precise control over inheritance distribution.

Hybrid Trusts – Subject the the legal principles established in trust law, we have the ability to develop trusts for nearly any lawful purpose, free from unnecessary invasive laws and disclosure requirements that could potentially expose trust assets to vexatious claims, all the while protecting the trust’s assets in accordance with its intentions.

About Us

Strategic Corporate Services Ltd is a leading independent Vanuatu professional services firm offering a comprehensive array of services to both corporate and private clients. Central to our range of services, is providing impartial guidance and assistance to individuals and families looking to establish trust strategies for asset protection and wealth preservation.

With years of experience navigating the intricate landscape of international finance and legal frameworks, we’re able to provide tailored solutions that meet the unique needs of our clients. From establishing robust trust structures to ongoing management and compliance, we ensure peace of mind and financial security for individuals, families, businesses, and organisations worldwide.*

Our in-house legal counsel oversees all communications, ensuring clients benefit from legal professional privilege and confidentiality in all their interactions and arrangements.

Vanuatu Trust Solutions: Navigating Centuries of English Trust Law

The common law system of trusts traces back to the mid-fourteenth century. From 1800 to 1875, UK courts refined doctrines, clarifying trust distinctions from other equity laws. The English law of trusts was codified post-1925 through Parliamentary Acts, evolving further via judicial decisions. UK trust laws stand as the gold standard, globally.

Importantly, Vanuatu’s legal system, fundamentally based on English law, has adopted and enforced trust laws, delivering entirely dependable trust structures to protect and fulfill the intentions of the trust’s settlor(s) and beneficiaries. Moreover, Vanuatu has developed its own legislation inspired by UK’s trust laws, offering additional protections and flexibilities to cater to the unique needs of individual clients.

- There is no provision for the registration of trusts in Vanuatu. All trust deeds are subject to stamp duty at the rate of 50¢ (with a minimum payment of US$75) for every US$100 or part thereof of the amount or value of the property settled. Trusts are normally settled for a nominal sum, eg US$100, as any additions to the corpus do not attract stamp duty. (USD$ is used here for convenience)

Trust establishment and structure:

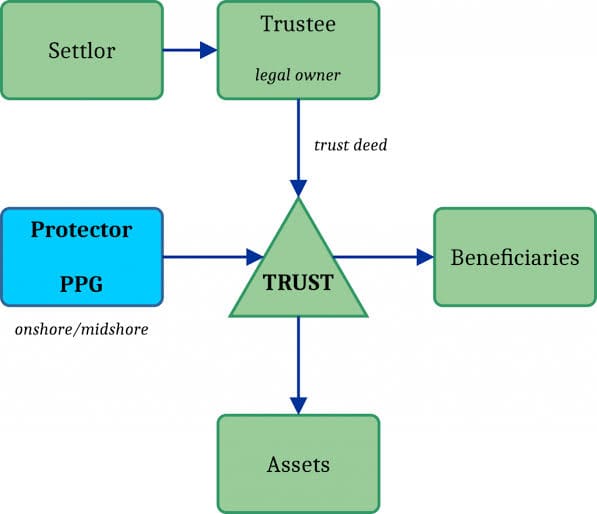

Vanuatu trust laws, governing both offshore and onshore trusts, are renowned for their reliability and robust protections. Depending on the specific intentions of the trust and its intended duration, a hybrid trust structure may offer additional benefits. Furthermore, creating the role of a Trust Protector in a Trust Deed, and delineating the roles of Trustee and Trust Protector, to that of Appointor, can enhance the veracity of trust’s asset protection and offer greater flexibility to take advantage of opportunities.

- A Trust Protector plays a pivotal role in safeguarding the integrity of a trust. Functioning as an impartial overseer, the Trust Protector ensures that trustees fulfill their fiduciary duties in alignment with the trust’s intentions. Whether the trust is established onshore, in Vanuatu, or offshore in another jurisdiction, our Trust Protector services offer invaluable assurance. By providing a watchful eye and intervention authority when necessary, we uphold the trust’s integrity, offering peace of mind to beneficiaries and preserving the trust’s purpose over time. Learn more about our Trust Protector services >

While the legal fundamentals of trust structures remain similar, the nuances and effectiveness of each trust type are largely determined by the intricacies of the trust deed and the jurisdiction in which the trust is established. Certain jurisdictions, particularly those with trust laws based on English trust law, such as Vanuatu, have implemented laws and protocols to minimise the potential for interference, a crucial consideration in an era where legal attacks on trusts are increasingly prevalent.

Advanced Trust Structures

In addition to establishing traditional trust structures like Private Trust Companies (PTCs), Blind Trusts, Discretionary Trusts, Fixed Trusts, and Family Trusts, our firm specialises in a diverse range of advanced trust structures. These include Hybrid Trusts, Dynasty Trusts, Child Maintenance Trusts, Charitable Trusts, Service Trusts, Pension and Annuity Trusts, Testamentary Trusts, as well as Domestic Asset Protection Trusts (DAPTs), Discretionary Spendthrift Trusts, Irrevocable Life Insurance Trusts (ILITs), Purpose Trusts, and Management Trusts.

Indeed, for high-net-worth individuals and wealthy families, a meticulously constructed trust with comprehensive legal safeguards is the most practical and cost-effective means of preserving wealth and facilitating intergenerational wealth transfer.

Tailored Trust Deeds: Wealth Protection & Strategic Planning

Our trust advisory services go beyond mere surface-level guidance. We specialise in crafting bespoke Trust Deeds tailored to accommodate the diverse range of interests and intentions of all involved parties, including future intergenerational beneficiaries.

Accordingly, crafting an initial Trust Deed can be time-consuming and is thus not an inexpensive exercise. Our services are more attuned to wealthy individuals, and entrepreneurs with a gleaming future. Indeed, entrepreneurs embarking on their journeys should consider establishing a trust from the outset to safeguard their hard-earned wealth against potential setbacks along the way, thus avoiding the need to divest assets during critical times—actions that could leave assets vulnerable to creditor clawback in certain jurisdictions. Thus, establishing a trust from the outset is a strategic decision made by forward-thinking individuals.

While establishing a corporate entity in Vanuatu can be a prudent strategy for conducting business or holding assets, the versatility and advantages of trusts cannot be overlooked. Trusts, in combination with a corporate entity offer a dynamic and flexible approach to asset management, operating across multiple jurisdictions and benefiting from the most advantageous legal frameworks. However, the devil is in the detail, as they say, and crafting a Trust Deed with clear and unambiguous intentions is paramount to avoiding legal disputes down the line.

Transferring intellectual rights into a trust

A classic example of transferring ‘intellectual rights’ is that of a songwriter. A songwriter, in-fact any artist, can absolutely transfer their rights, such as copyright or royalty rights, into a trust. This can be done to achieve various purposes, including estate planning, asset protection, and efficient management of intellectual property assets. By transferring the rights into a trust, the songwriter can ensure that their intellectual property assets are managed and distributed according to their wishes, both during their lifetime and after their passing. Additionally, placing these rights into a trust can offer certain benefits such as privacy, flexibility, and potential tax advantages.

Proactive monitoring and advisory services

Our dedicated trust advisory team closely monitors global developments, enabling us to provide proactive guidance to ensure that our clients remain ahead of regulatory changes and emerging challenges.

Moreover, through our extensive professional affiliations and memberships, we vigilantly monitor global developments in trust law applications. This enables us to seamlessly construct, adapt, and relocate trusts to alternative jurisdictions when beneficial for our clients.

While maintaining our advisory and/or Trust Protector roles, we leverage advantageous incentives offered by various jurisdictions without necessarily altering the trust’s legal structure. This proactive approach ensures optimal trust management, maximising benefits for our clients while safeguarding their interests.

Our Trust Expertise & Affiliations

At Strategic Corporate Services, we specialise in preparing and establishing trusts, ensuring that the intentions of the trust are safeguarded and carried out as intended.

Our firm boasts a network of affiliations with trust experts spanning various jurisdictions. This enables us to provide independent advice and ongoing support throughout the decision-making process, ensuring that your wealth protection strategy is tailored to your specific needs and goals.

Protecting your assets begins today, and by entrusting Strategic Corporate Services, you’re securing the financial future of your children and future generations. Learn more about Vanuatu’s role as an Offshore Financial Centers in Global Private Credit …

Our Corporate Services

Selecting the most suitable company structure demands careful and thorough professional analysis. We’re dedicated to collaborating closely with our clients and their representatives to craft tailored structures and strategies that precisely match their unique and particular needs. Instead of applying a generic approach, we prioritise customisation to ensure optimal outcomes for every client. Learn more …

Initial Contact

In the first instance, all initial enquires should be made via our ‘secure contact portal’. Upon receipt, we shall promptly address a mutually convenient time for an initial consultation.

Secure Contact Portal

Note: Our services are not offered to Australian or New Zealand interests

For convenience, we typically conduct electronic face-to-face meetings, often via Skype or a similar platform. These meetings allow us to assess the scope and complexity of your intentions, ensuring compliance with your objectives. Additionally, this serves as the first step in our Know Your Customer (KYC) obligations, which we strive to make as unintrusive as possible.

For our high (and ultra-high) net worth clients and families, we go the extra mile by arranging one of our legal representatives to meet you or your designated representative(s) at a mutually convenient location. This ensures that we can provide personalised and comprehensive services tailored to your specific needs and circumstances.

Fees

Our professional fees are structured in alignment with the scope services rendered, as well as any necessary costs, including for application and establishment, and disbursements incurred. We believe in transparency and fairness, ensuring that our clients receive value for their investment. Additionally, we offer complimentary initial consultations, allowing prospective clients to explore our services without any financial obligation.

Initial Consultation

For convenience, we typically conduct electronic face-to-face meetings, often via Skype or a similar platform. These meetings allow us to assess the scope and complexity of your intentions, ensuring compliance with your objectives. Additionally, this serves as the first step in our Know Your Customer (KYC) obligations, which we strive to make as unintrusive as possible.

For our high (and ultra-high) net worth clients and families, we go the extra mile by arranging one of our legal representatives to meet you or your designated representative(s) at a mutually convenient location. This ensures that we can provide personalised and comprehensive services tailored to your specific needs and circumstances.

Confidentiality & Privilege

Confidentiality and discretion is paramount. Our team, overseen by in-house legal counsel, ensures all services meet stringent legal compliance standards, safeguarding our clients’ interests and unique structures. Thus, we prioritise the highest levels of confidentiality to protect our clients’ sensitive information.

With robust measures in place, we mitigate risks of unauthorised access or breaches, providing clients peace of mind and assurance that their affairs are securely handled with professionalism and care. Learn more …

* Strategic Corporate Services Ltd does not directly provide trustee services. Instead, we maintain an independent advisory role across all facets of a trust’s arrangements, including serving as a Trust Protector.

Vanuatu Trusts